FE502 – Central Bank Balance Sheet Analysis

How to get the Data

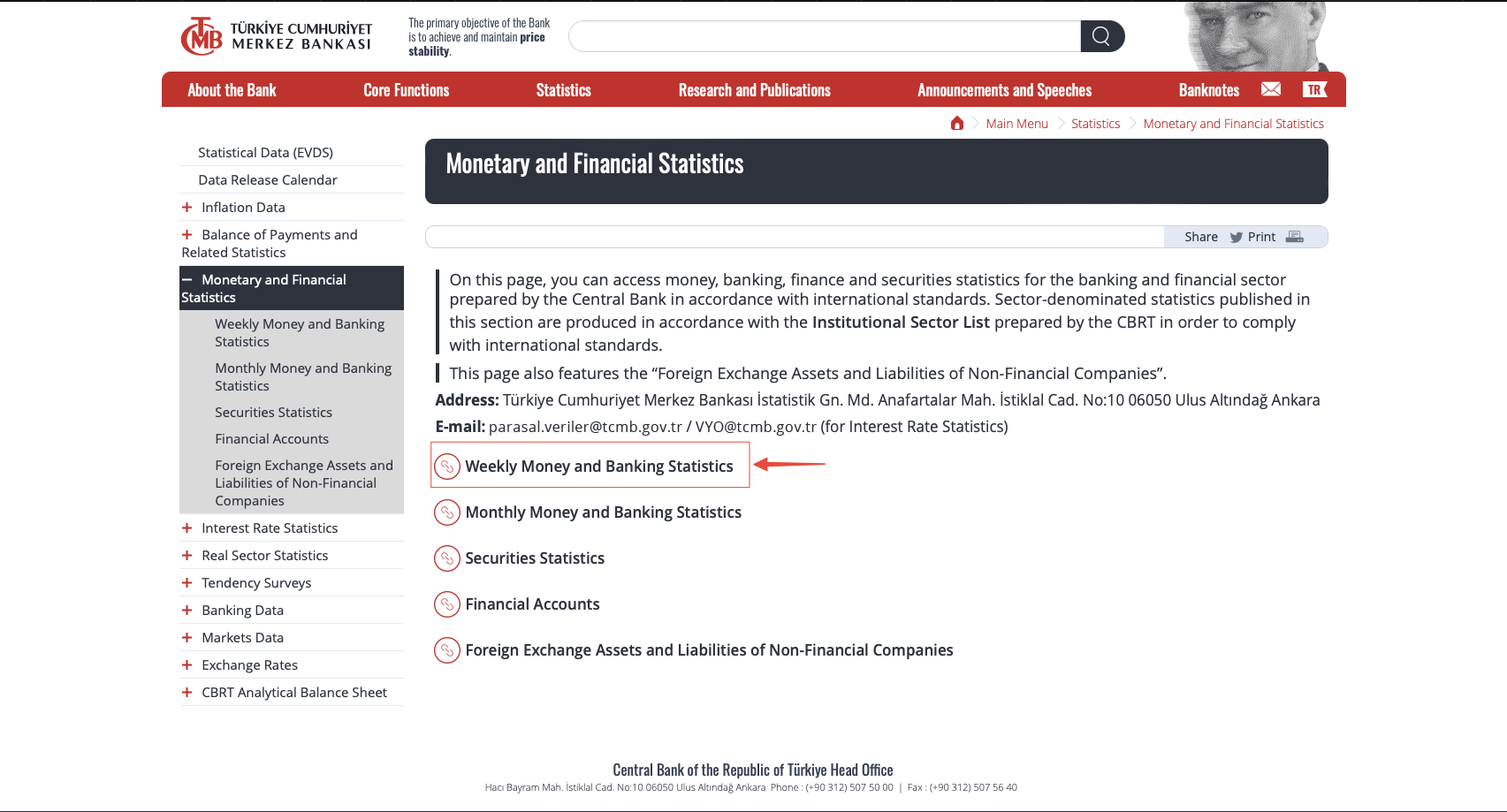

Open the Official Website of the CBRT then select “Statistics” from the main menu, then select “Monetary and Financial Statistics” .

Click Weekly Money and Banking Statistics from the opened new page.

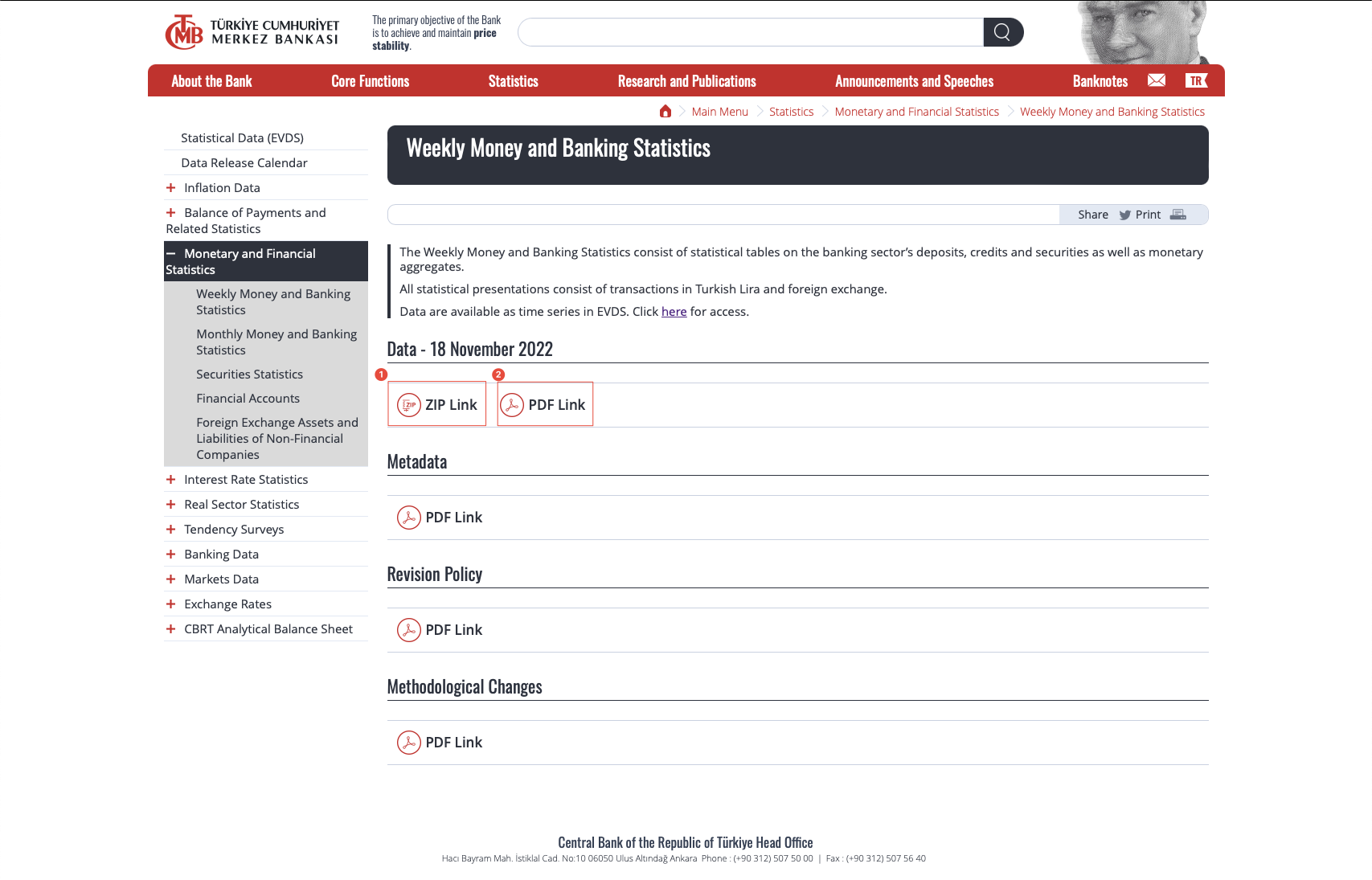

Download the latest data as Excel (1-ZIP Link) or PDF (2-PDF Link)

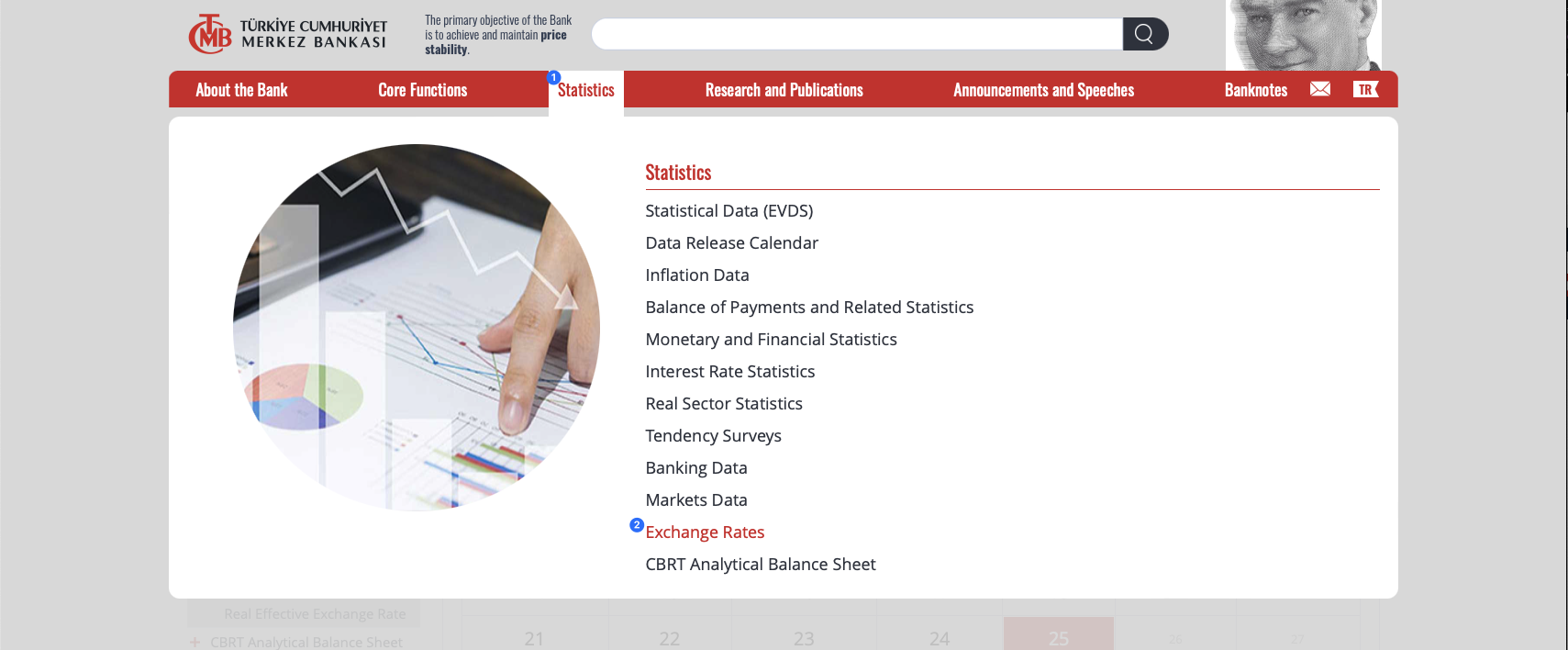

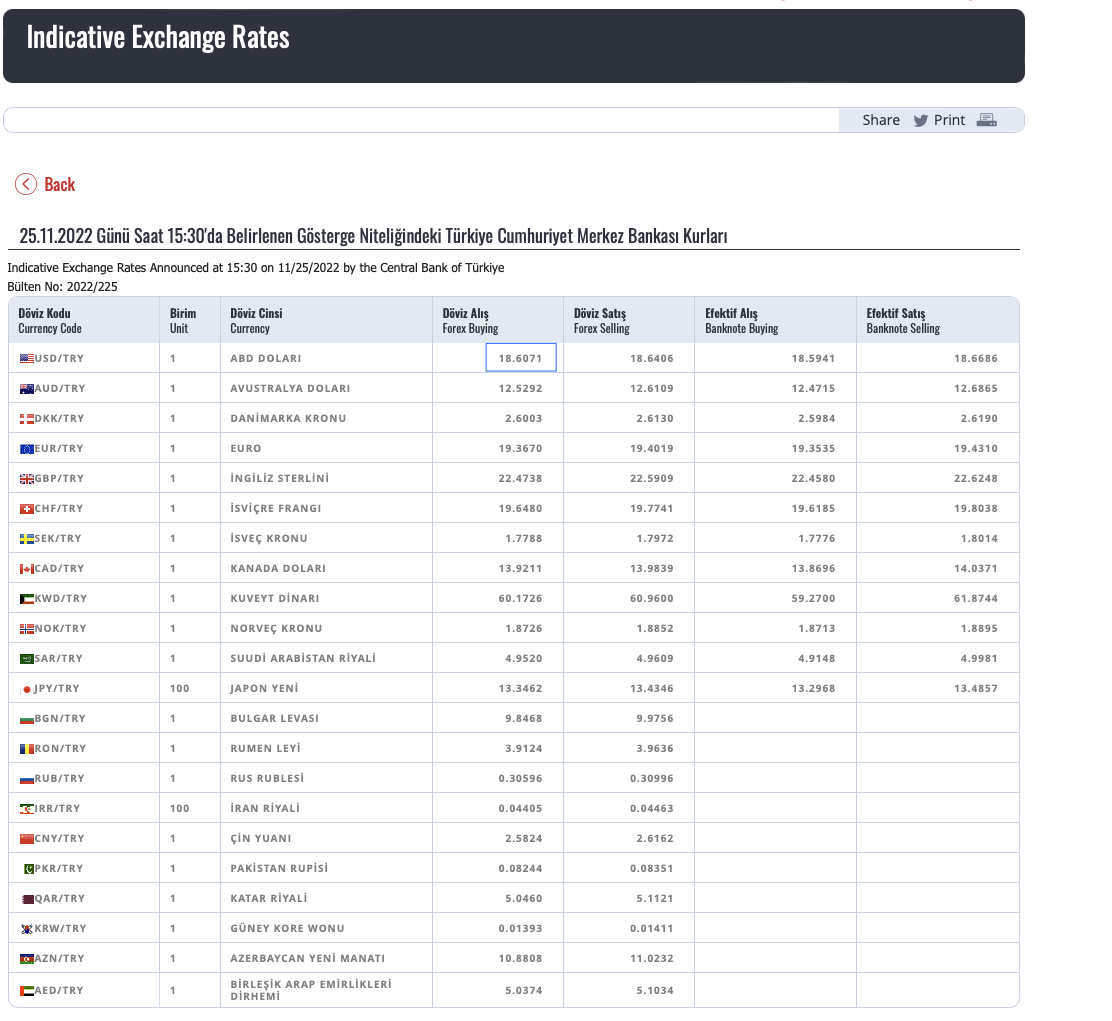

Extra - Get the previous day CBRT dollar exchange rate.

How to read and Analysis data (FX assets)

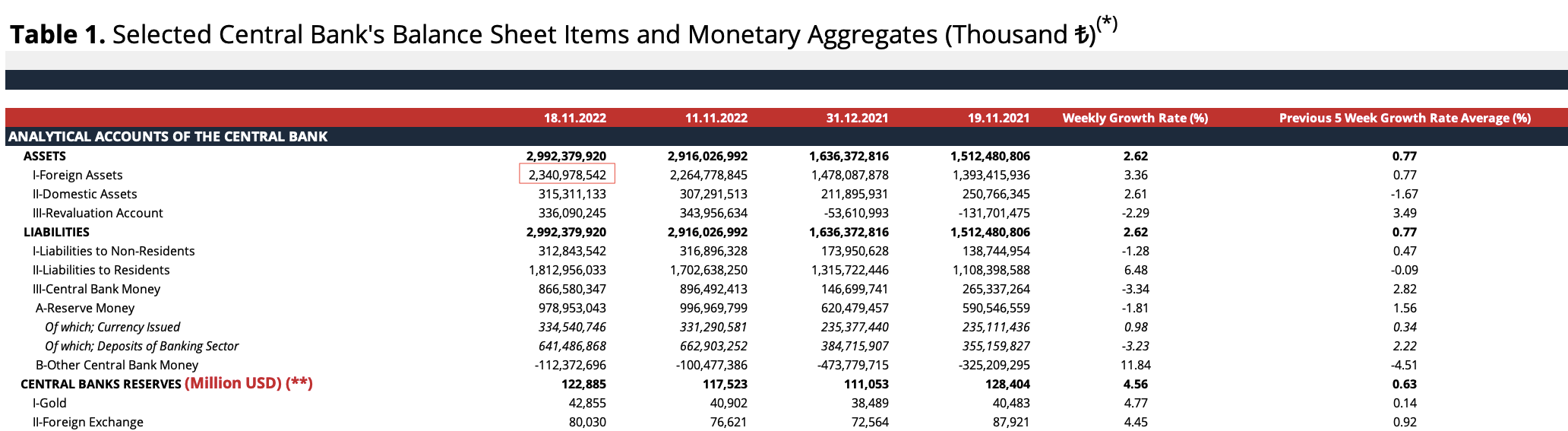

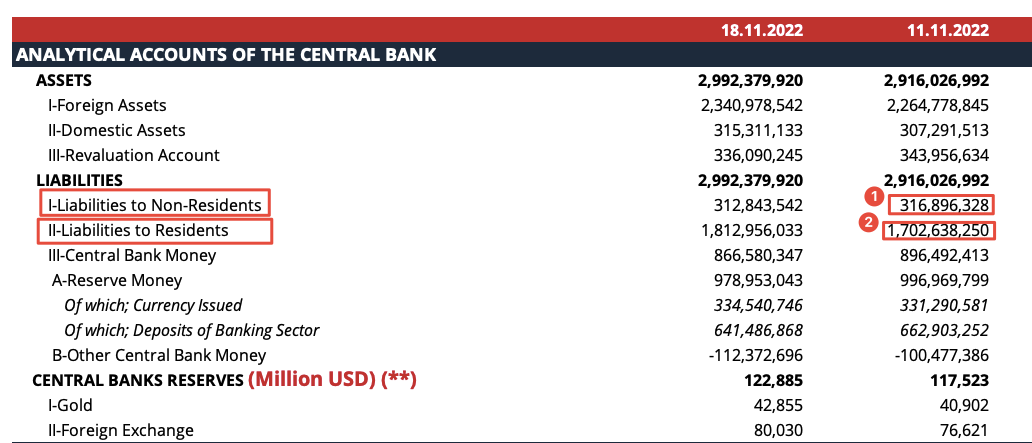

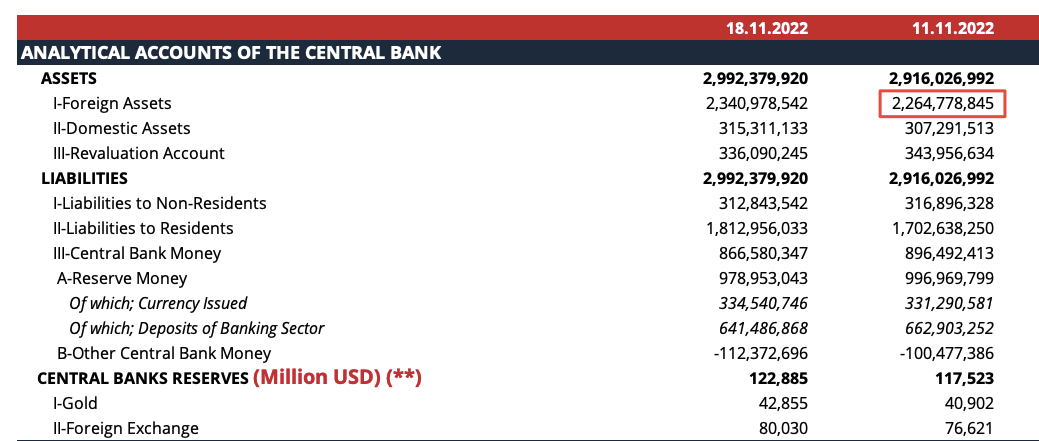

- Read the total Foreign Assets (FX assets in TL) from the table (first for numbers)

we read as 2340 (this is in TL) 2 trillion 340 billion

2340 [18]

2264 [11]

FX assets in the balance sheet in TRY is about 2340

FX assets in the balance sheet in USD is about 2340 /18607 =~ = 126 Billion

2340 / 18607 = 126 billion. [18]

2264 / 18611 = 122 bilion [11]

How to read and Analyse data (Net FX position of CB (total assets - total liability))

Why this is very important?

Because those reserves show the power of the country, how much finance is grossed at public sector.

Net reserve shows how much the central bank is able to approach the financial market, tackle the problem of shortage of liquidity to the market, if there is a sharpened economy, that is why net reserve is extremly important.

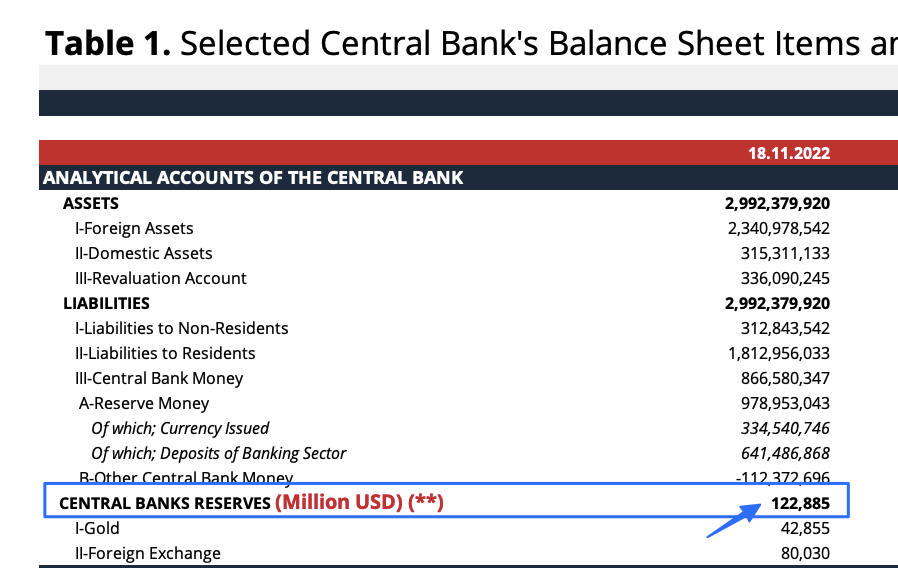

Assets

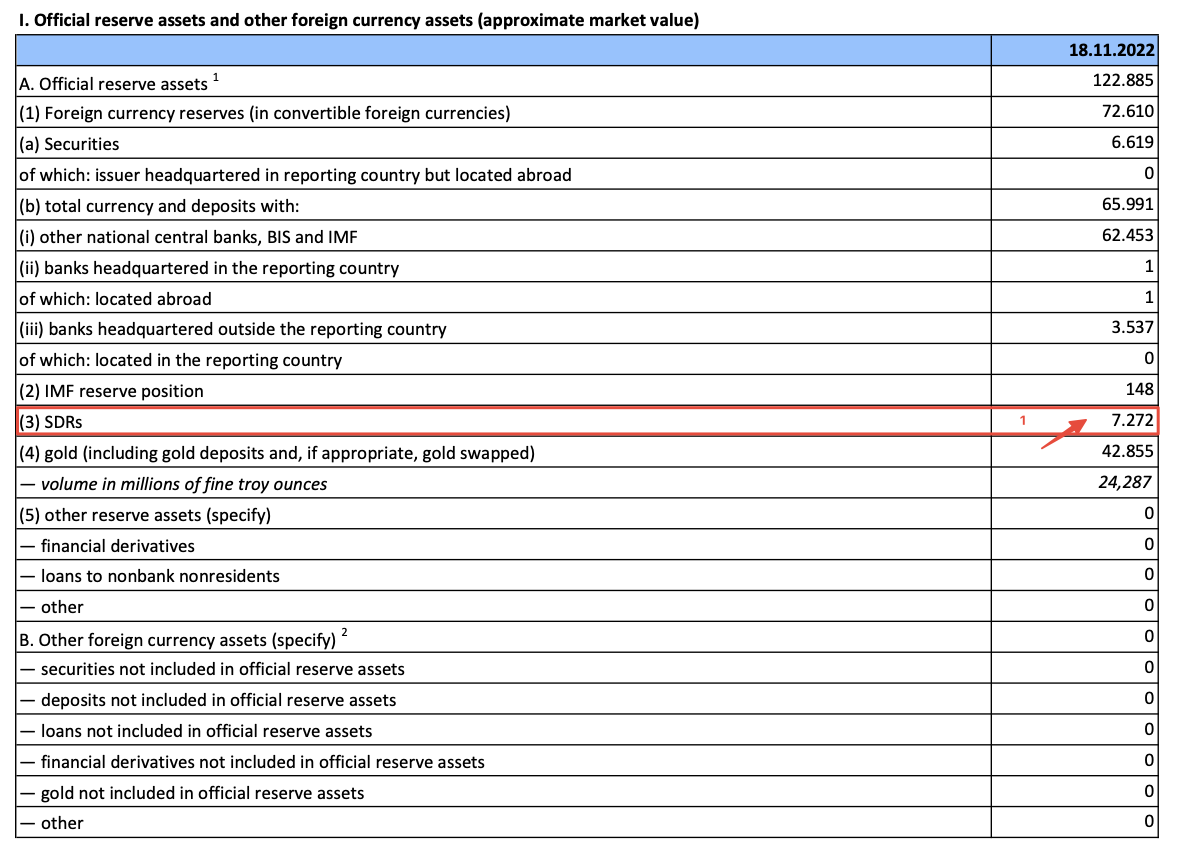

Assets: Total assets = 122 million dollars./

Liabilities

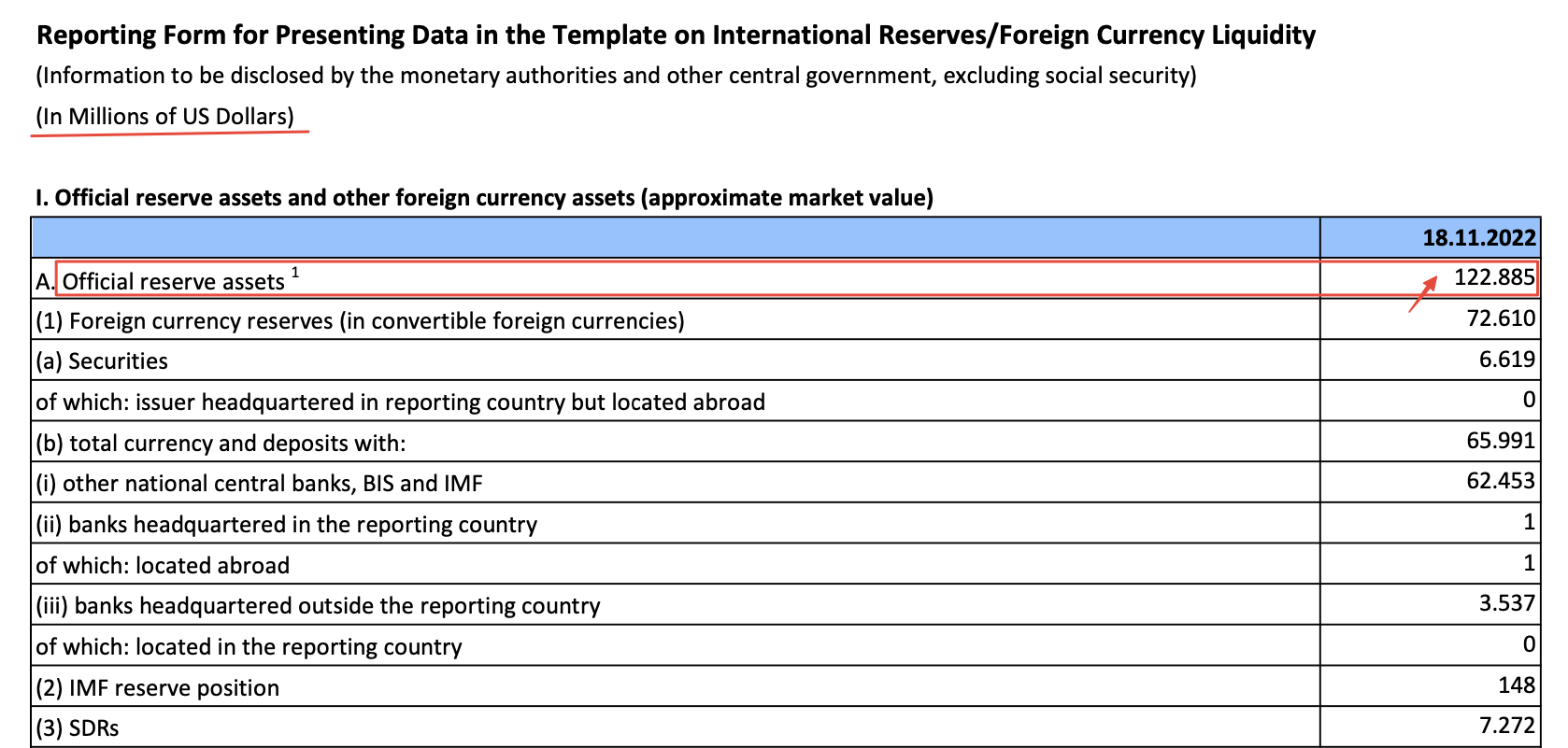

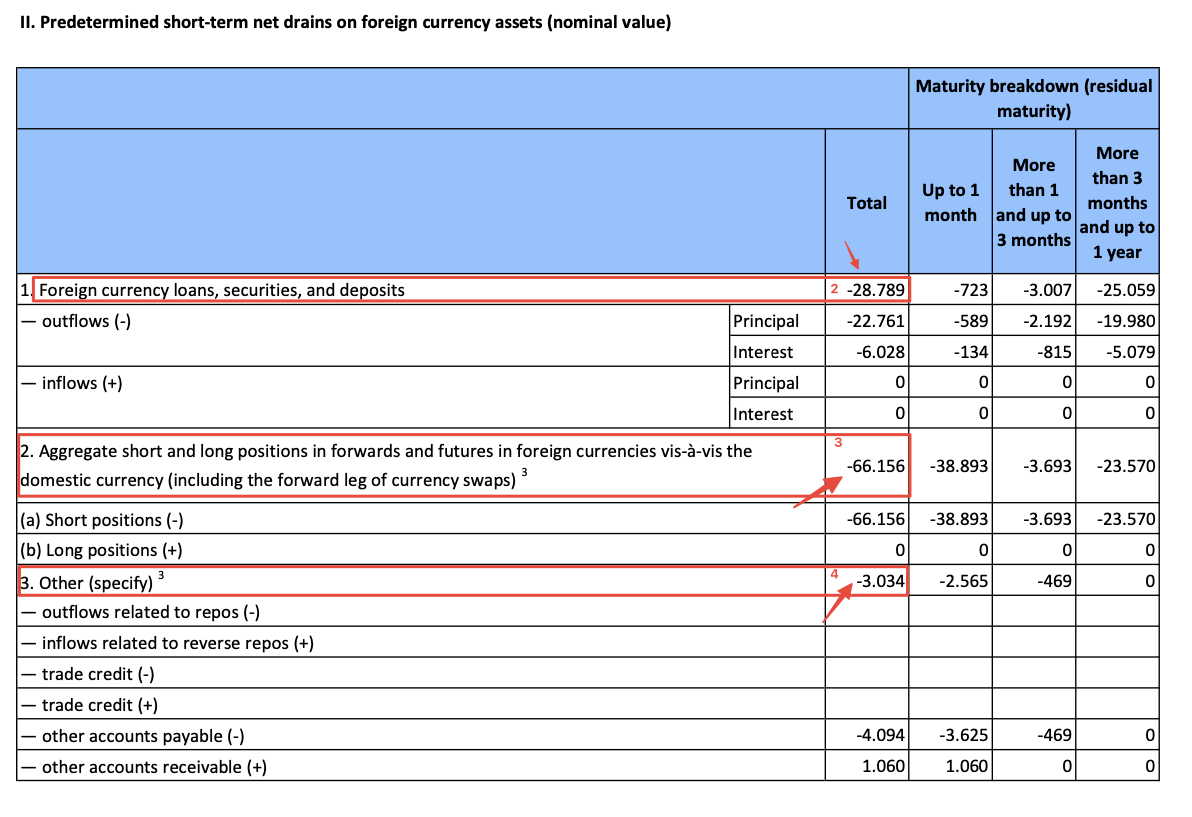

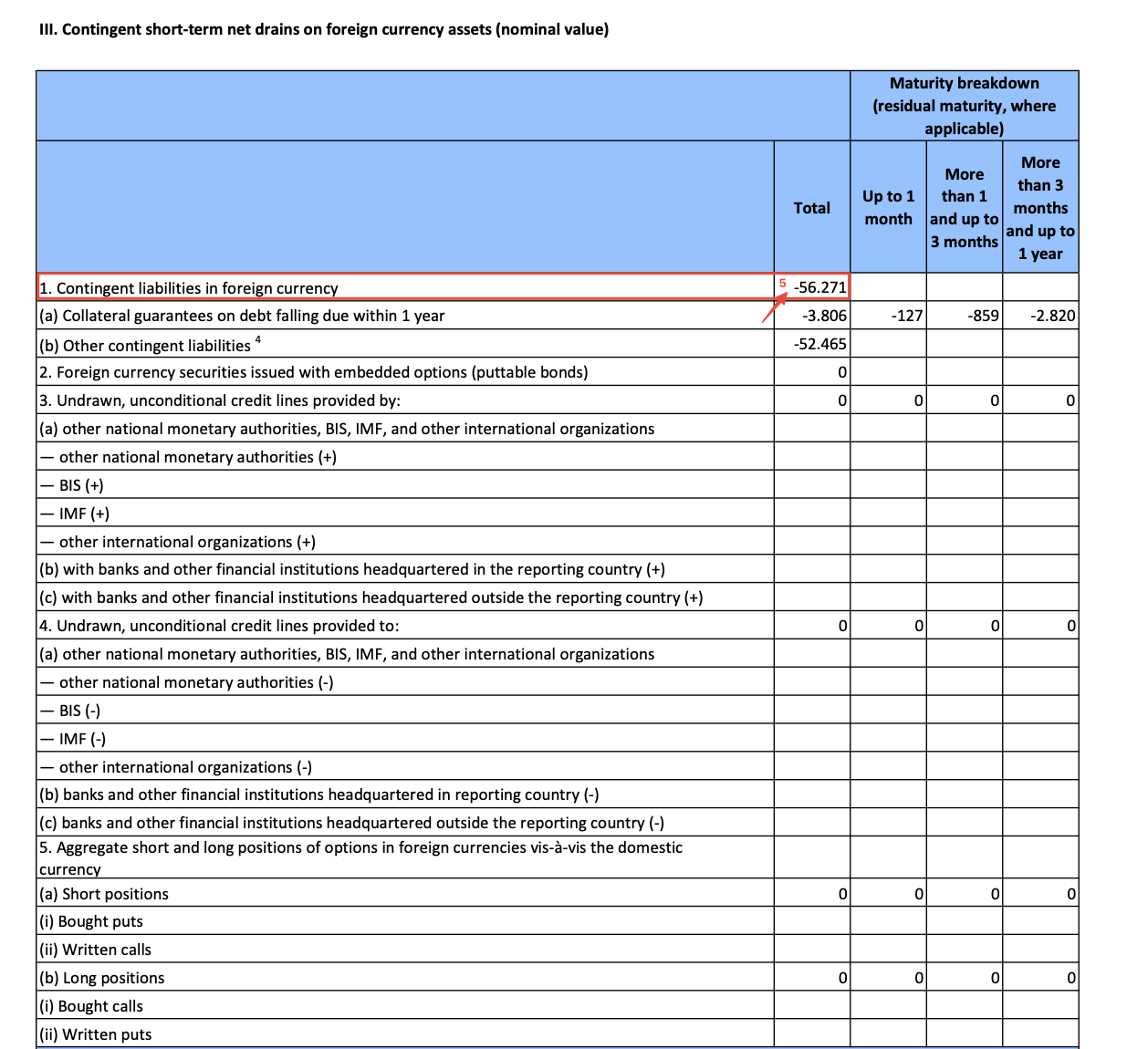

FX total Liabilities = (1)SDRs + (2)Foreign Currency Loans, Securities and deposits + (3)FX positions and Currency Swaps + (4)Others + (5)Contingent liabilities in foreign Currency

for [11.11] this would be:

total FX assets = 117523

total FX liabilities [11.11] = 7130 + 28477 + 69440 + 2938 + 53302 = 163287

Net FX reserve = Total FX assets - Total FX liability = 117523 - 163287 = - 45764

So total FX reserve = -45764 million USD = -45 billion USD

So: TR cbrt net reserve = -45 billion USD.

for [11.18] this would be:

total FX liabilities [11.18] =

+= 7272

(SDRs)

+= 28789 + 66156 + 3034

(fx loan + fx positions and swaps + others)

+= 56271

(contingent liability)

total fx liability [11.18] = 7272 + 28789 + 66156 + 3034 + 56271 = 161522

total fx assets = 122885

net fx reserve = 122885 - 161522 = -38637 million USD = -38 billion USD

So: TR cart net fx reserve = - 38 billion

How to read and analyse net open positions of the CB

Net FX reserve is different from teh net posion of the CB.

Everything recorded in the liquidity statement is off balancesheet.

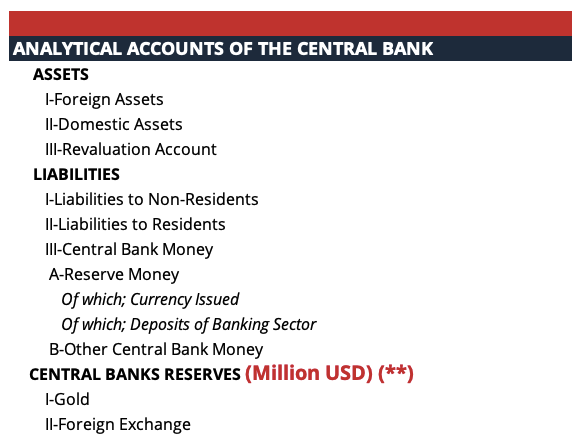

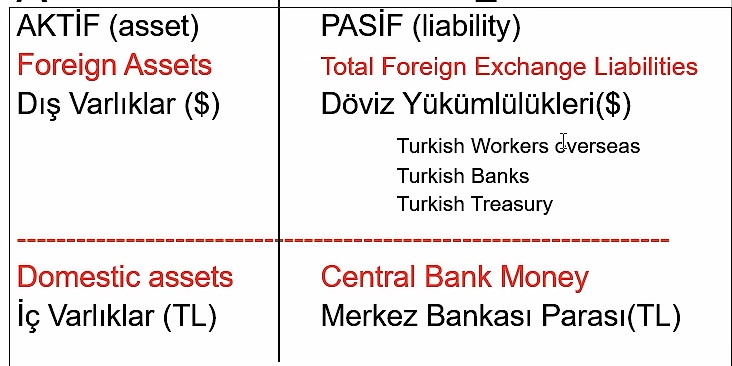

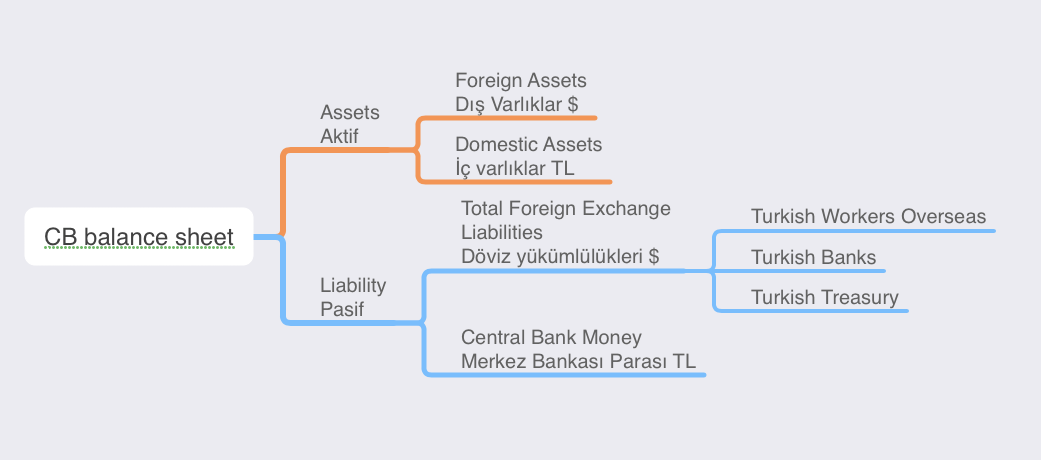

The domestic asset is basically the goverment debts, composed of two parts :

- goverment securities (majority of the portion)

- rediscount credits given to the banks

The revaluation account out of the domestic assets, gives another asset item in terms of the gain and loss of the large fx assets due to the dollar exchange rate changes.

The evaluation account shows that the central bank is making profit or loss due to the dollar rate.

Because of the dollar rate is going up, the CB is making profit of it’s fx assets.

FX liabilities in TL [11.11] = Liability to non-residence (FX liability)(1) + Liabilities to resicents (Domestic liability)(2) = 316 + 1702 = 2018

FX liabilities in USD [11.11] = 2018 / 18611 = 108.43

Net position in TL = 2264 - 2018 = 246

Net position in USD = 246 / 18611 = 13.217

Net open position ( on balance sheet) [11.11] = 13217 billion dollars

Net open position (off balance sheet) [11.11] = 13217 - (69440+2938) = - 59201

Net open position of the CBRT (off balance sheet) = -59201

off balance sheet : take consideration of the all swap borrowings, the central bank off balance sheet can be calculated.

In summary, CB net position is -59 billion dollars,

in terms of net reserves, everything included, the open position is -45 billion dollars.

If the results are minus, that means the liabilities are more than the assets.